Insurance Software Development Solutions

At Bluetris Technologies, we develop intelligent, secure, and compliant custom insurance software that help insurers in streamlining their operations and stay competitive. With deep InsurTech expertise and experience in working around the challenges of the legacy, we develop platforms that help to speed up the underwriting process, automate claims, and increase fraud detection without complicating your processes.

Why Choose Bluetris for Insurance Software Development

Our offerings accelerate underwriting, automate claims, and improve fraud detection so the challenges in your industry can be turned into competitive advantage. We have deep InsurTech experience as a team, and first-hand knowledge of the legacy that traditional systems leave behind.

Rather than replacing old software, we create a custom insurance software to help your teams more efficiently, remain in compliance with regulations and deal with complicated operations without additional friction.

Our Full Spectrum of Insurance Software Development Services

We provide all-in-one insurance software development to automate the operations, minimize the manual labor, and improve the customer experience. Our solutions can assist insurers to effectively handle policies, claims, and risk by automating and integrating modern technologies with industry knowledge to remain responsive to future requirements.

InsurTech Consulting

Strategic counseling and practical discoveries to leverage digitalization trends, new technologies, and innovative insurance software solutions for competitive advantage.

Insurance App Development

User-friendly mobile and web applications for policyholders, agents, and stakeholders with self-service portals that improve customer relationships and loyalty.

Insurance Risk Management Software

Intelligent risk management software that identifies, assesses, and mitigates operational and financial risks using advanced algorithms and predictive analytics.

Insurance Fraud Prevention Software

AI and machine learning-powered solutions that identify suspicious patterns, anomalies, and potential threats to protect assets and minimize operational risks.

Policy Management Software

Comprehensive solutions that simplify the entire insurance policy lifecycle from issuance through renewal with automated workflows and increased accuracy.

Insurance Document Management

Secure repositories with workflow automation and version control to efficiently store, retrieve, and manage insurance records while ensuring regulatory compliance.

Legacy Software Modernization

Upgrade outdated systems to scalable, flexible platforms with smooth integration, minimal operational disruption, and enhanced efficiency using advanced technologies.

Insurance Quoting Software

Create accurate and fast quotes by automating calculations, integrating real-time data, and simplifying workflows to improve customer experience and conversion rates.

Insurance Compliance Software

Compliance-oriented solutions for GDPR, PCI DSS, NAIC, FINTRAC, and IRDAI regulations that ensure transparency, minimize regulatory risks, and maintain legal standards.

Insurance CRM Development

Specialized CRM applications for insurance to enhance customer interaction, retention, and sales with customer profiles, lead management, and multi-channel communication.

Claims Management Software

Streamline the claims lifecycle from intake through adjudication and settlement with automation, enhanced communication, and optimized resource allocation.

Insurance Marketplaces Development

Build marketplace and aggregator platforms with integrated quoting engines, multi-vendor support, and comparative features for easy product search and purchase.

Insurance Billing Software

Automate premium collection and payment management with advanced payment processing, customized billing, and automated workflows to boost cash flow and satisfaction.

Insurance Underwriting Software

Optimize risk evaluation and premium pricing with analytics, rules engines, and decision support tools to increase profitability and market competitiveness.

Agency Management Software

Provide brokers and agents with comprehensive tools for client management, policy tracking, and commission processing to enhance productivity and relationships.

Insurance Technology Architecture

Explore our comprehensive insurance solutions designed to accelerate operations, enhance security, and maintain regulatory compliance.

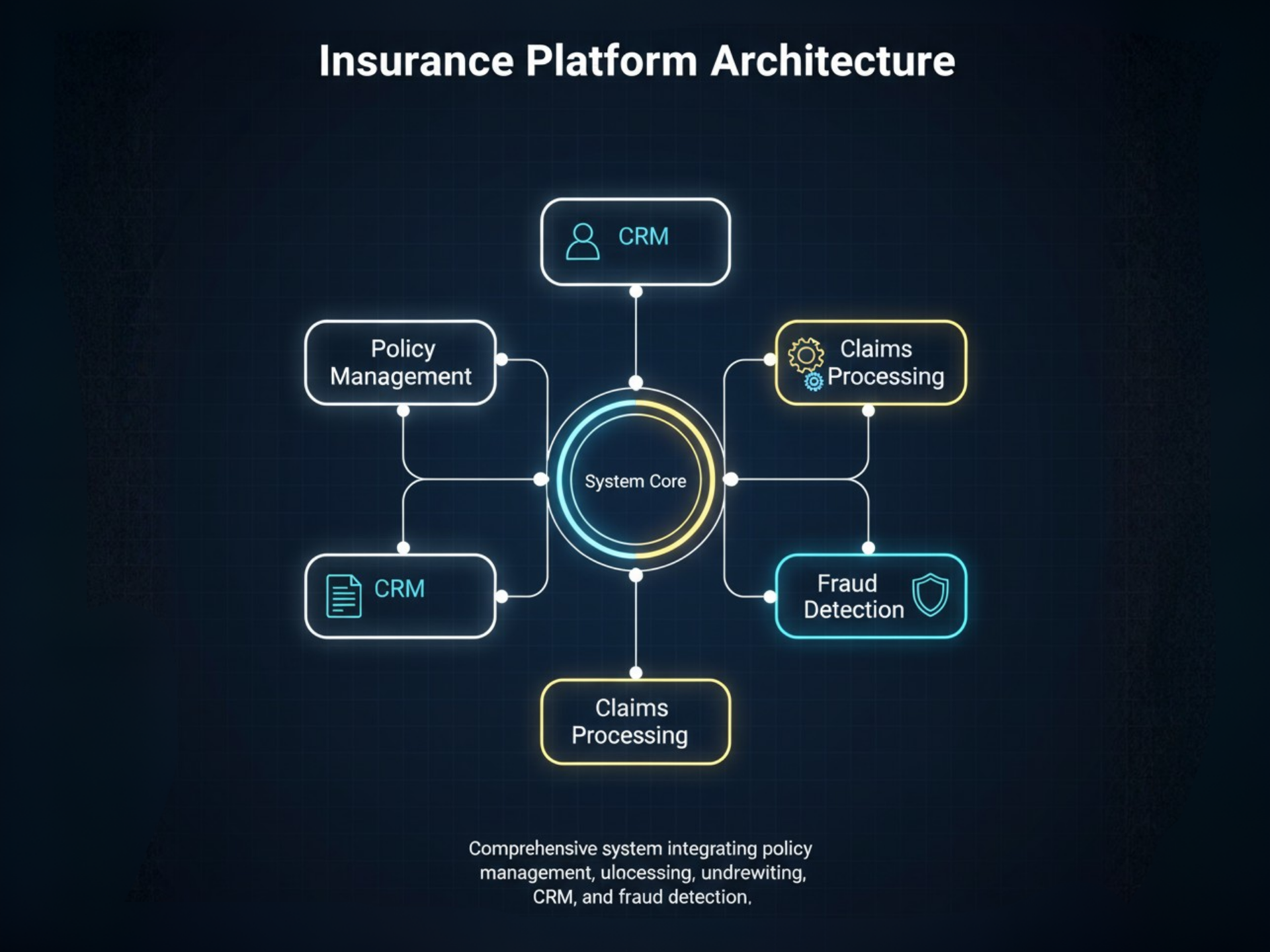

Insurance Platform Architecture

Comprehensive system integrating policy management, claims processing, underwriting, CRM, and fraud detection.

AI-Powered Claims Automation

Automated document processing, fraud detection, risk assessment, and approval workflows using machine learning.

Risk Management & Compliance

Regulatory frameworks, security protocols, data encryption, and compliance monitoring for insurance operations.

Why Choose Bluetris Technologies for Custom Insurance Software Development

We provide insurance software solutions that are secure, compliant and technically excellent, as we are a full-scale insurance software development company. With a history of providing digital solutions to businesses globally and a team of talented and experienced designers, our tailored insurance software application services will grow as your business grows, comply with international regulations, and yield quantifiable outcomes.

Infrastructure Security

We put security on the first plan on any project. To make your data and operations as secure as possible, our platforms are encrypted with AES-256, authenticated with multiple factors, supported with secure APIs, and Threat Detection monitors.

Compliance as a Software Design

Our development process has regulatory compliance. Our software is capable of fulfilling requirements no matter which framework you use, be that IRDAI, GDPR, SOC 2, AML, PCI DSS, or others, as it is built to be easily audited and updated.

Enterprise-Grade Solutions that deliver results

Our solutions are oriented to the actual business results. We develop modernizing legacy systems and AI-integration to fasten underwriting, minimizing risk, streamlining operations, and opening new revenue sources.

Artificial Intelligence-Powered Smartness

Our AI and machine learning are integrated into the automation of claims, risk assessment, and predictive analytics to help insurers make decisions faster and smarter, improve customer service, and remain competitive in the market.

Advanced Technologies Powering Our Insurance Software Development Services

We leverage cutting-edge technology to address real challenges in the insurance value chain. We make our solutions secure, scalable, and collaborative and provide smooth experiences to both policyholders and insurance teams.

Artificial Intelligence (AI)

AI changes the way insurers work. We design smart virtual assistants to support policyholders 24/7, automate underwriting, detect fraud in real time, and perform predictive modeling that improves customer experience.

Generative AI

Generative AI allows the production of custom policy documents, automated customer responses, and data-driven recommendations to underwriters in real-time to provide faster speeds to daily operations without making them unhuman.

Agentic AI

Agentic AI systems are independent of automation. They handle claims, identify anomalies, and real-time adjust workflows and make sure operations run smoothly as staff are now free to deal with complex cases.

Blockchain

In situations where transparency and trust are paramount in cases of insurance, we use blockchain solutions. These are tamper-proof claims, automatically executed smart contracts, and permanently auditable policy systems.

Internet of Things (IoT)

The IoT-enabled solutions enable connected policy systems to receive live data, to facilitate the usage-based pricing and to initiate early response that can speed up or even prevent the claims.

Augmented/Virtual Reality (AR/VR)

AR/VR technologies ease the operations of insurance between customers and employees. Some of them are virtual property inspection, interactive damage assessments, and guided onboarding without physical visits.

Metaverse

Our metaverse creates experiences on metaverses to train and involve users in new experiences. This involves virtual consultations, simulated demonstrations of insurance products and realistic online training platforms.

Data Analytics

Our analytics engines clarify insurance making decisions. Dynamic pricing, extensive customer segmentation, and policy generation in real-time allow insurers to respond in a better and quicker way.

Cloud Computing

Scalable, reliable and resilient systems are guaranteed by cloud-native architecture. Our solutions offer scalable performance, instantaneous updates and high business continuity to insurance operations.

Our Proven Insurance Software Development Process

Bluetris Technologies develops insurance software that is secure, compliant and scalable as required. We code more than just a solution so that all solutions work with your operations, comply with regulatory requirements such as IRDAI, GDPR or AML and change as your business requirements change.

Requirement Analysis

We begin by getting to know what you do in terms of insurance. These include assessment of the current systems, problem areas and what the software has to do. Regulations like IRDAI, SOC 2 or PCI-DSS are made part of the early days, not an afterthought.

Roadmap Planning and Architecture

Having requirements, we develop an elaborate roadmap. This consists of choosing the technology stack and choosing between cloud-native and hybrid architecture. The modular design is compatible with CRM, payment gateways and reinsurers.

Security & Compliance Setup

Security comes at the very beginning. AES-256 encryption, multifactor authentication, protected APIs, audit reports, and real-time monitoring are done instantly. Every regulatory system is mapped against technical controls.

UI/UX Design

We develop interfaces that are user-friendly. The agent, underwriter and customer dashboards ease processes such as claims, renewals and managing policies using both desktop and mobile systems.

Agile Development

Our team adheres to agile practices that provides the most vital features first be it a quote engine, a fraud-detecting AI, a policy management module, or a risk scoring system. Integrations built through API are done in stages.

Testing & Quality Assurance

The testing is comprehensive and real-world. Vulnerability scans, penetration testing and real world insurance scenario simulation is supplemented with unit, regression, performance and security tests.

Deployment & Integration

We integrate the software to your desired setup Cloud, hybrid or on-premise. The migration of data in the legacy system is done cautiously and full test is done to all integrations with CRMs, ERPs and partner APIs before launching.

Post-Launch Support

Once we are deployed, we do not stop monitoring as we keep addressing the issues, rolling out updates, and ensuring continued compliance. With constant feedback and analytics, the platform can be optimized.