FinTech Software Development Solutions

At Bluetris Technologies, we build secure and regulatory FinTech software that help financial institutions and banks stay competitive in a digital-first world. Our solutions simplify complex workflows, automate processes and improve customer experiences bridging the gap between legacy systems and modern financial innovation.

How FinTech Software Is Transforming the Finance Industry

FinTech software applications enable individuals to have the power over their finances be it via saving, credit, secure payments or mobile investments. These applications, in eliminating the traditional banking visitation, also provide 24/7 accessibility, smooth user experiences, and intelligent financial applications. Fraud protection, analytics and real-time alerts—FinTech software is transforming the financial behavior of consumers and businesses.

FinTech Market Growth & Adoption

- Adoption Rate (%)

- Market Size ($B)

Our FinTech Software Development Services

We offer end-to-end fintech software development solutions that would help revise the financial processes, improve user experiences, and business growth. With advanced technologies including AI-powered analytics, blockchain security, and cloud infrastructure, our solutions simplify payment, digital banking, lending, and investment processes, and provide secure and scalable and regulatory-compliant platforms to both a financial institution and a startup. Need expert developers? Hire our full-stack team.

Custom Fintech Software Application

Our services include web and mobile development of custom fintech software which allows more user engagement, personalized financial reporting, and real-time data analytics to banks, financial institutions, and fintech startups.

Accounting Information Systems

We are an Accounting Information Systems (AIS) provider of QuickBooks, Sage, and SAP, combining it with ERP systems and fintech startup and enterprise-specific intelligent business analytics solutions.

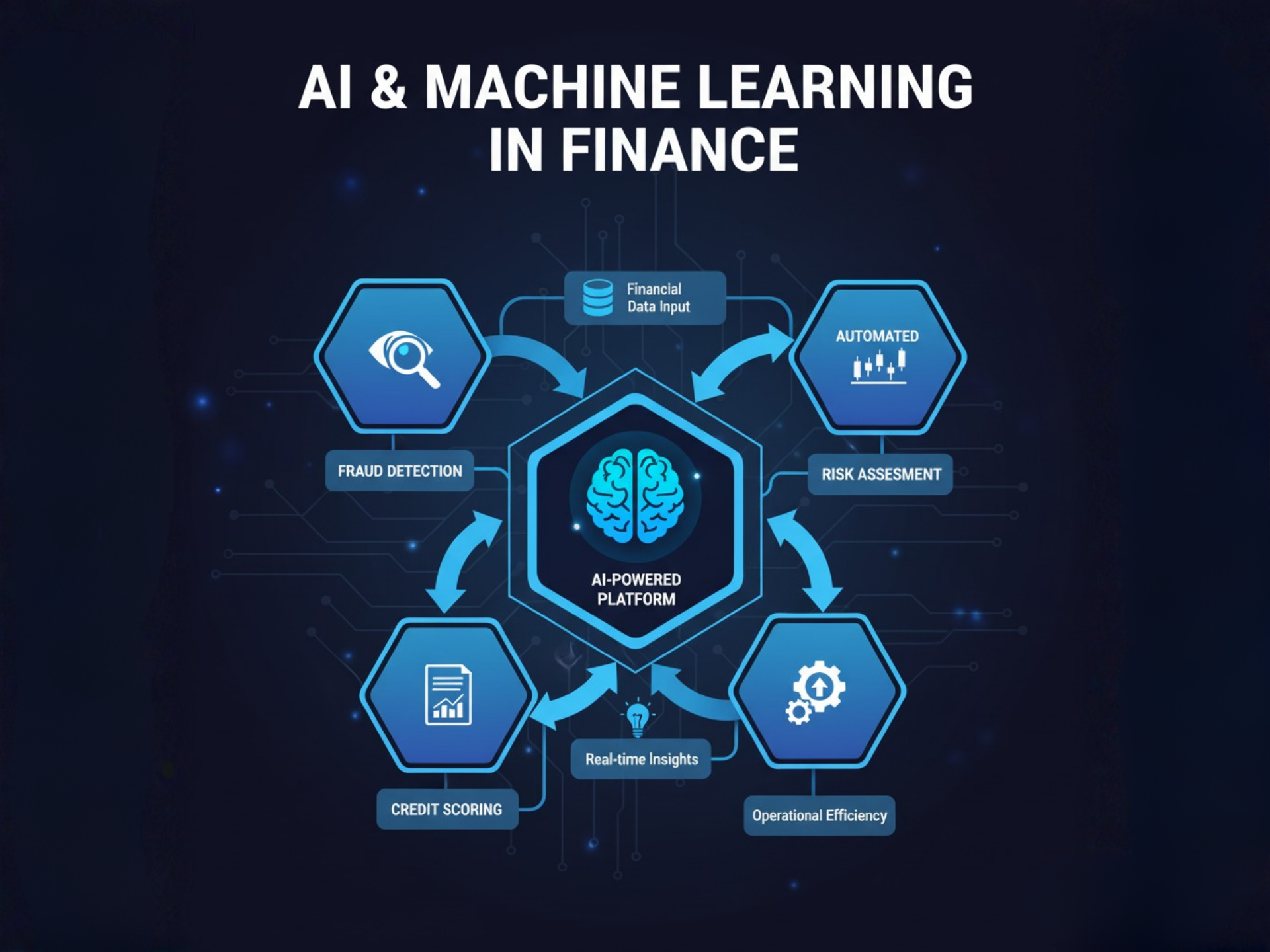

AI-enabled Fintech Solutions

Our AI-based fintech offerings assist financial institutions to better their decision-making processes, automate their operations, and to better their interactions with customers by making use of intelligent financial management systems.

Intelligent CRM Solutions

We combine cloud-based CRM systems and developed technologies to enhance financial management, including microservices architecture, voice-enabled solutions and intelligent automation.

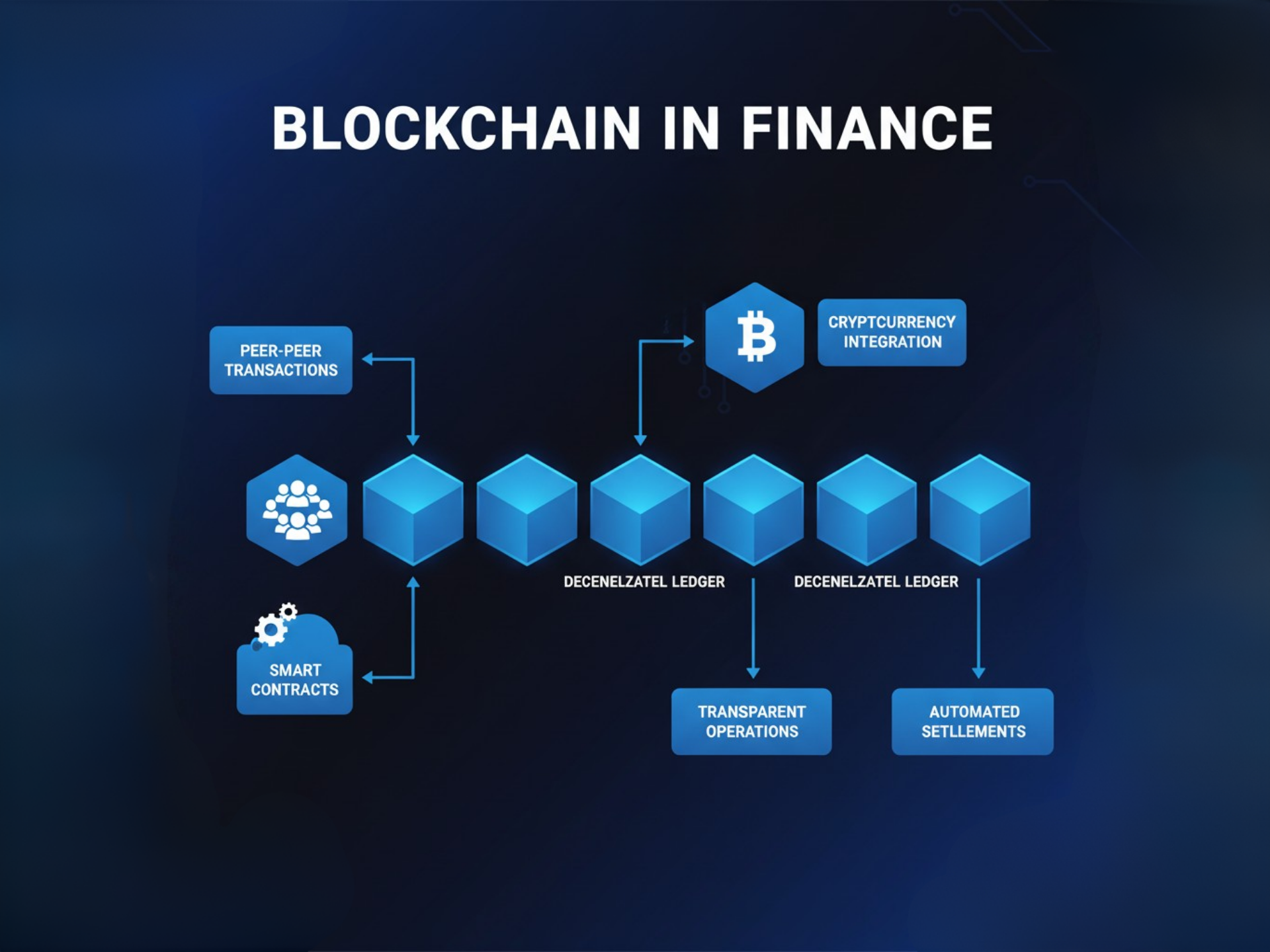

Blockchain Development

We create and implement scalable blockchain-based financial software that provides better security of your data, transparency, and efficiency of your financial ecosystem.

Robotic Process Automation

We create RPA robots to help investment companies to automate repetitive financial tasks, minimize manual workflow, and facilitate the overall operation efficiency.

IoT-enabled Security Cameras

Our IoT experts design smart security cameras to track the valuable assets of the users in real-time, thus offering real-time outage detecting and report-on-the-fly features to improve client experience.

Digital Wallet Development

Our team of fintech software developers develops digital wallet softwares that helps the banks and other financial institutions to customize the promotions based on the needs of individual clients.

FinTech Architecture & Security

Our comprehensive approach to building secure, scalable, and compliant financial technology solutions

Digital Banking Transformation

Modern banking architecture with mobile apps, API gateways, core banking systems, and secure payment processing layers.

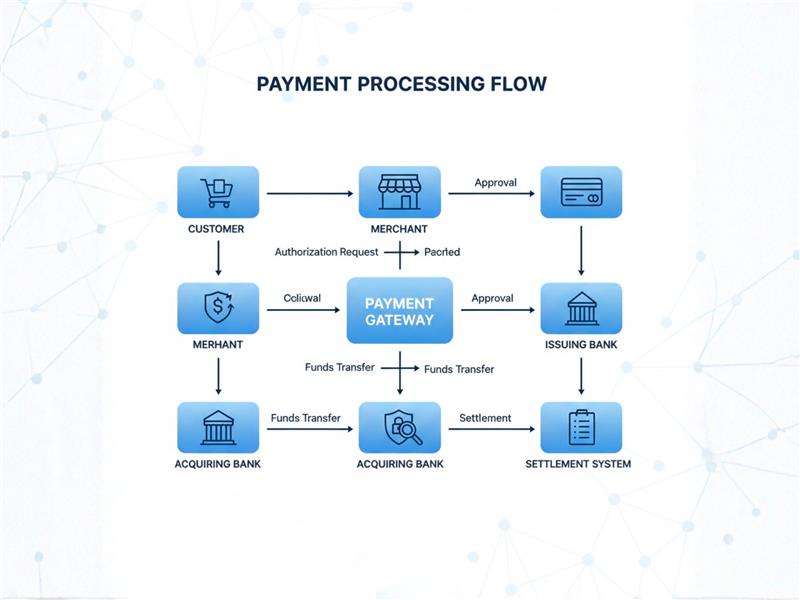

Payment Processing Flow

End-to-end payment architecture with fraud detection, encryption, bank network integration, and settlement systems.

Multi-Layer Security Architecture

Comprehensive security framework with encryption, authentication, firewall protection, and threat detection systems.

Our FinTech Solutions Tailored to Your Specific Business Needs

We offer fintech solutions to your business objectives, in the form of consumer banking and digital payment solutions as well as wealth management and investment solutions. As a trusted fintech software development partner, our tailor-made solutions across the full financial ecosystem will make you optimize operations, improve customer experiences, and build sustainable growth.

Transaction Volume & Speed

- Transactions (M)

- Avg. Speed (s)

Security Compliance Distribution

Wealth Management

Our fintech software is used to streamline the process of tracking assets, investing and planning portfolios. Combined with real-time analytics and purposeful dashboards, our solutions provide smooth, smart and informative wealth experiences.

Consumer Banking

We create safe, easy to use business banking programs of all levels. Our solutions make transactions to be completed seamlessly, customer support to be better, and provide efficient digital banking experiences.

Insurance

Our fintech solutions include digital insurance processes, automated insurance claims and fraud detection. Our platforms make underwriting cheaper and faster and make our customers more trustful.

Lending

We develop lending solutions that have quick approval, KYC, and repayment manager. Our fintech will be a security-focused and speedy piece of software that automates the process and allows lenders to scale credit services.

Personal Finance

Our personal finance applications assist users in controlling the amount they spend, determining bills, and automating the savings. We enable people to make accurate financial decisions easily and clearly.

Payment

We develop mobile payment software that is speedy, secure and user-friendly. Our platforms ensure encrypted transactions, rewards, and fast transfer platforms offering credible and smooth payment experiences.

RegTech

Our RegTech solutions are automated compliance and risk management. Our AI-based platforms make reporting easier, provide real-time notifications, and assist financial organisations to be audit-ready.

Accounting

Our accounting software is designed to automate data entry, control invoices, and monitor transactions in real time. Our fintech solutions are compliance-based, more accurate and offer insightful reports.

Advanced Technologies Powering FinTech Innovation

Leveraging cutting-edge technologies to create secure, intelligent, and future-ready financial solutions

Blockchain in Finance

Decentralized ledger technology, smart contracts, peer-to-peer transactions, and cryptocurrency integration for transparent financial operations.

AI & Machine Learning

Advanced AI/ML workflows for fraud detection, credit scoring, risk assessment, personalized recommendations, and automated trading.

Compliance & Security

Enterprise-grade security architecture ensuring PCI DSS, GDPR, GLBA, and SOC 2 compliance with multi-factor authentication.

Emerging Technologies to Power Your FinTech Solutions

At Bluetris Technologies, we take advantage of the emerging and already established technologies to make financial software faster, more secure and prepared to inhabit the current digital-first market.

Operational Cost Savings with FinTech Solutions

- Manual Processing

- Automated FinTech

Why Partner With Bluetris Technologies for FinTech Software Development

FinTech is not a vertical to us, but it is a place where we have continuously provided high-compliance high-performance software on a large scale. From custom FinTech application development and with their end-to-end solutions to regulated institutions. Our solutions are trusted by financial leaders of various industries.

Specific Software in Controlled Financial Systems

We develop every FinTech solution in such a way that it can meet the needs of the auditors, regulators, and actual users. Our platforms are in control, transparent, and traceable since the very first day.

Scalable and compliant FinTech Platforms

Regulatory standards such as PCI DSS, GDPR, GLBA, DORA and MAS TRM have been integrated into all layers of code, infrastructure and workflows by our development team. Your FinTech platform is very safe, scalable, and secure.

Experienced Expertise in Sophisticated Financial Solutions

Bluetris Technologies have assisted institutions to roll out real products as opposed to MVPs. We have experience across the full FinTech stack, ensuring performance at scale.

Our Fintech Software Development Process

At Bluetris Technologies, we specialize in building of scalable, secure, and future-ready FinTech solutions. The end-to-end development process is designed in such a way that it will help enhance efficiency, ensure regulatory compliance, and provide users with a unique experience.

Frequently Asked Questions

What factors influence the development of a FinTech software solution?

There are a number of factors on which the implementation of a FinTech solution depends, including its feature set, level of security required, tech stack, compliance requirements, integrations with third party, and scaling needs. Key Benefits: We'll collaborate with you to evaluate these factors and develop a custom solution that meets your business goals.

How long does it take to build a FinTech software?

The timeline depends on the size of the project. A minimum viable product (MVP) costs about 3–5 months, mid-level software/application level takes 6–9 months, and a sophisticated enterprise solution with a lot of features can exceed 12 months.

How do you ensure data security in FinTech applications?

We follow top-tier security parameters such as end-to-end encryption, multifactor authentication, secure APIs, and compliance with regulations including PCI-DSS, GDPR, and SOC 2. Real-time threat monitoring and routine audits are part of the package.

Do you provide post-launch support for FinTech products?

Absolutely. We provide the end-to-end maintenance and support services upon the FinTech software release: performance optimization, security updates, new features releases, as well as the compliance with the latest standards patches to support you as you continue your FinTech solution development.

Can you modernize our legacy financial software?

Yes, we are invited to bring forward old financial systems with a breath of new air; either as a whole or through specific code refactoring, UI/UX enhancements, cloud-driven services, reshaping the payment process pipeline, and more. Our modernization strategy means performance, security, and future growth with little to no disruption.