The Challenge

Legacy System Integration

Complex integration requirements with existing monolithic architecture

Regulatory Compliance

Strict US insurance regulations and data retention policies

High Data Volume

Managing large volumes of customer feedback and dispute data

Minimal Disruption

Deploying new features without affecting ongoing operations

Performance Improvements

Response Time Improvement (hours)

- Before Implementation

- After Implementation

Issue Type Distribution

Customer Satisfaction Score Trend

- CSAT Score

Comprehensive Solution Modules

Customer Feedback Management

Real-time feedback collection and sentiment analysis across all touchpoints

- Web/Mobile Integration

- NPS Surveys

- Rating Scales

- Analytics Dashboards

Complaint Management

Structured complaint lifecycle with categorization and SLA tracking

- Issue Categorization

- Auto-Escalation

- SLA Management

- Resolution Timelines

Dispute Management

End-to-end dispute resolution workflow with compliance tracking

- Dispute Lifecycle

- Claims Disputes

- Billing Errors

- Audit Trail

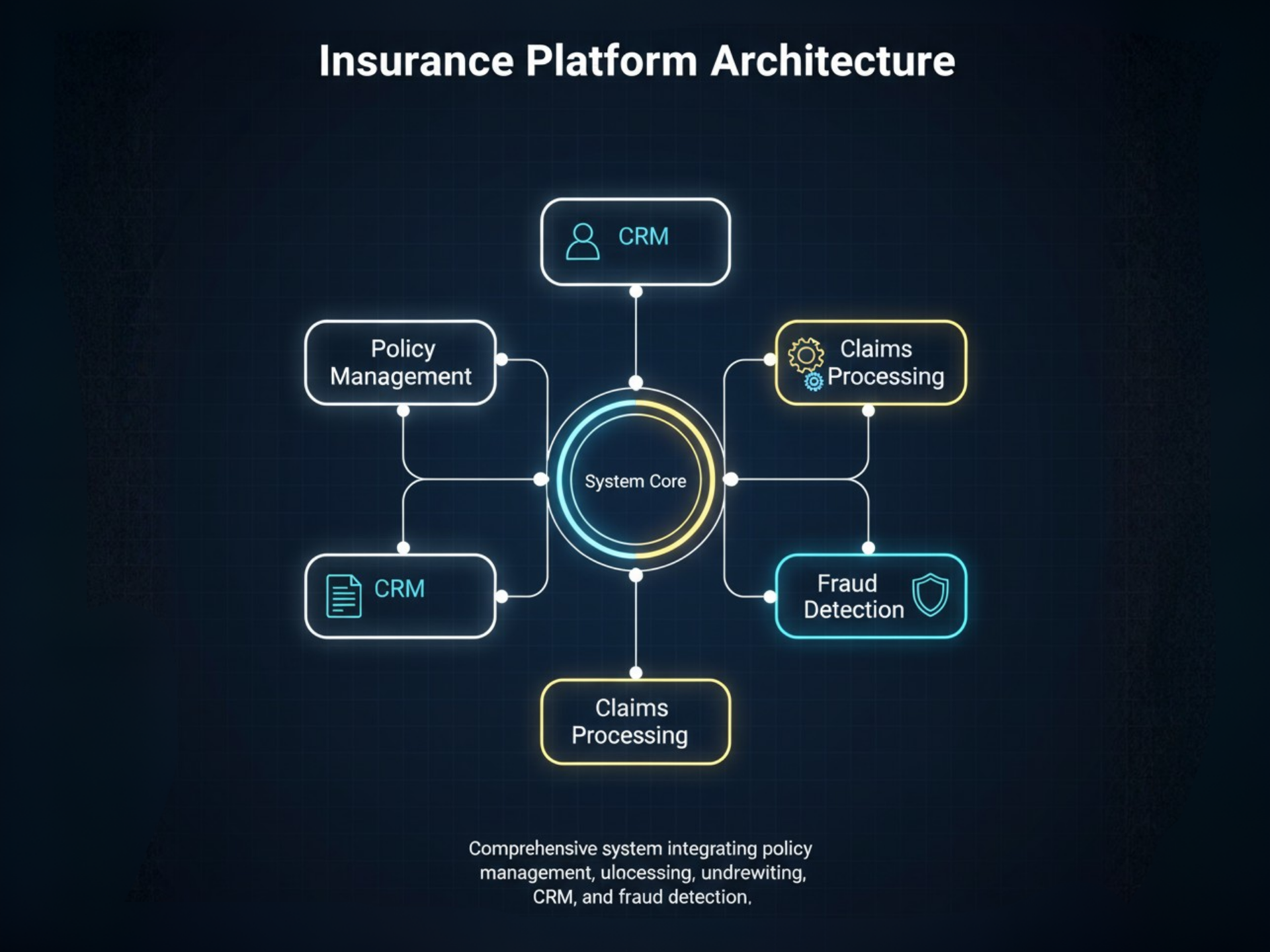

System Architecture

Visual representation of the insurance platform architecture and workflows

Platform Architecture

Microservices-based modular architecture for scalability

Claims Automation

Automated claims processing and dispute resolution workflow

Risk Management

Comprehensive risk assessment and compliance tracking

Technology Stack

Frontend

- React.js

- Angular

- TypeScript

- Responsive Design

Backend

- Java Spring Boot

- Node.js

- RESTful APIs

- Microservices

Database

- PostgreSQL

- MongoDB

- ElasticSearch

- Redis Cache

Cloud & DevOps

- AWS ECS

- AWS RDS

- Lambda

- CloudWatch

Integrations

- Salesforce CRM

- Twilio

- Email Services

- SMS Gateway

Security

- OAuth 2.0

- JWT

- Encryption

- Audit Logs

Analytics

- ElasticSearch

- Kibana

- Custom Dashboards

- Sentiment Analysis

Monitoring

- CloudWatch

- Application Logs

- Performance Metrics

- Error Tracking

Business Impact

Key Achievements

45% improvement in response time to customer disputes within first quarter

30% increase in customer satisfaction score (CSAT)

100% regulatory compliance for dispute resolution processes

65% reduction in call center load through self-service tracking

Scalable microservices architecture for future growth

Seamless integration with legacy systems using feature toggles

Strategic Value

The implementation of customer feedback, complaint, and dispute management modules transformed the insurance provider's customer service operations. The modular microservices architecture ensured minimal disruption while providing scalability for future enhancements. Compliance with US insurance regulations was embedded throughout the solution design.

"The new modules have dramatically improved our customer service capabilities. We now have complete transparency in our dispute resolution process, which has strengthened customer trust and helped us exceed regulatory requirements."

— VP of Customer Experience

Let's Accelerate Your Success

Ready to reduce deployment time by 90% and achieve 99.9% uptime? Schedule your free consultation with our certified DevOps experts today.

Choose Your Preferred Contact Method

Book Video Call

Free 30-min consultation

Discuss your infrastructure needs

Why Choose Bluetris?

Get Your Free DevOps Assessment

🔒 Your information is secure. We'll never spam or share your data.